By Emily Blobaum, Fearless editor

On July 15, more than 36 million families across the U.S. began receiving the first round of child tax credit payments.

We spoke with nonprofit leaders and one Iowa family on what the credit will mean for middle- and low-income households in the state.

Background

The child tax credit was temporarily expanded under the American Rescue Plan that was passed by the U.S. Congress in March. Previously, the maximum yearly credit families received was $2,000 per dependent child under 17 and families who didn’t earn enough money to pay income taxes couldn’t get the full credit.

Now, families will receive $3,000 per child age 6 to 17 and $3,600 per child under 6. Half of the credit will be distributed monthly, starting in July and continuing through December. The other half will be available once families file their 2022 taxes. That comes out to $250 per month per child age 6 to 17 and $300 per month per child under 6.

The credit is available to single filers making up to $75,000 a year, single head-of-household filers making up to $112,500 a year and married couples filing jointly making up to $150,000 a year.

The expanded credit has a one-year price tag of $105 billion. The Biden administration and congressional Democrats hope to make the program permanent.

Why it’s significant

Experts say the expanded child tax credit could cut childhood poverty in half. Iowa could see nearly a 40% drop in child poverty.

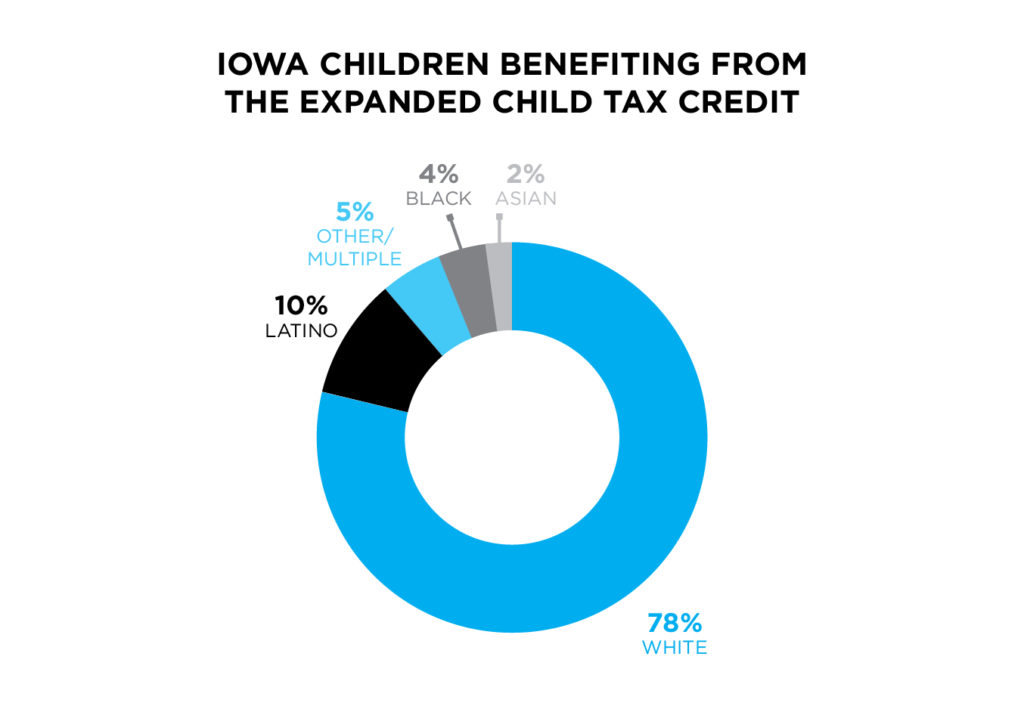

In Iowa, the credit will benefit 669,000 children. Of those children, 78% are white, 10% are Latino, 4% are Black, 2% are Asian and 5% are other/multiple races, according to the Center on Budget and Policy Priorities.

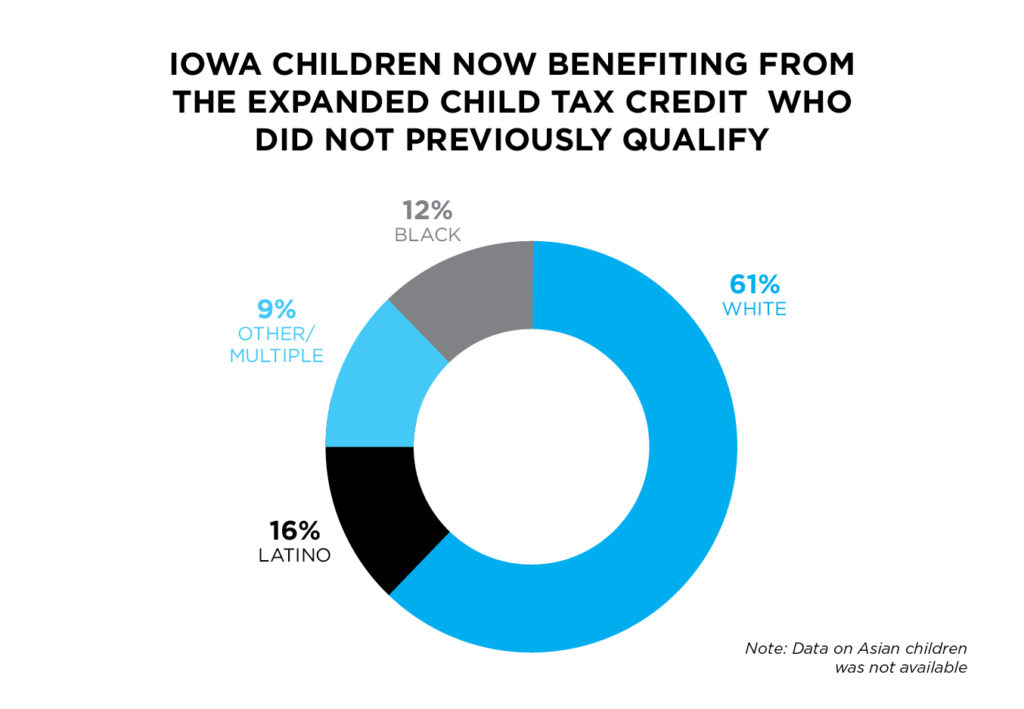

The expanded credit is now available to 27 million children who weren’t able to access the previous $2,000 credit, including nearly half of all Black and Latino kids. In Iowa, 198,000 children who were left out of the previous credit are now eligible – 61% of them white, 16% Latino, 12% Black, 9% other/multiple (Asian N/A).

Michelle Book, CEO of the Food Bank of Iowa: “Inequity is causing problems in our culture. The child tax credit is an income equalizer. … When you’re living in an environment where you cannot cover the basic needs of your household and your children, that creates incredible stress and leads to lots of problems that could simply be solved if they had a few more dollars in their bank account and could pay to have a flat tire fixed or have money to buy a bus ticket to work, can make sure they can fill their prescriptions for mental health. That all ensures they can maximize their employment opportunities and buy food for the household. It’s a big game of dominoes. All these things are interconnected.”

Anne Bacon, executive director, Impact Community Action Partnership: “It’s a great step forward in reducing the amount of families who deal with the challenges that come with poverty. It’s a great step forward. It won’t solve the problem, but it will be very helpful. … One of the big deals with this is being able to get it out to families upfront so their money can be used when they need it. They really need the cash in their pockets now.”

Where things stand in Iowa

Income and poverty

- The current federal poverty level for a family of four is $26,500. In 2019, 7.3% of families in Iowa lived below the poverty level.

- A person working full time at Iowa’s minimum wage would make $15,080 – or $2,200 above the federal poverty guideline for one person.

- The average annual household survival budget for a four-person family in Iowa is $56,772, according to United Way’s 2018 ALICE Report. The report also states that 66% of Iowa jobs pay less than $20 per hour, or $41,600 per year.

- More than 450,000 households in Iowa – or 37% – struggle to afford basic household expenses.

Child care

- A two-parent household in Iowa earning the 2019 median income of $61,691 pays between roughly 8% and 12% of their pretax income to send their infant to child care. For a single-parent household, that jumps anywhere from 27% to 41%.

- Child care often represents a family’s largest expense. The 2018 ALICE Report states that it costs an average of $1,031 per month for a family to send both an infant and a preschooler to a licensed and accredited child care facility.

- More than 16,000 Iowa families receive child care assistance.

Housing

- To afford a two-bedroom apartment, a family needs to make $33,224.

Food insecurity

- One in six Iowans and one in five Iowa children are food insecure.

- More than 300,000 Iowans receive benefits from the Supplemental Nutrition Assistance program.

- More than 200,000 Iowa children – or 42% of total K-12 students in the state – qualify for free or reduced lunch.

What it will mean for families

For Camille Juarez and her partner, Antonio Downing, both 24, the expanded child tax credit is a source of relief – they’ll receive a total of $6,600.

Juarez and Downing have one 9-month-old daughter, Veda, together. Juarez also has another 8-year-old daughter, Isabelle.

Born 3 pounds 13 ounces, Isabelle is immunocompromised, which meant that Juarez had to stay home with her while she attended elementary school virtually, rendering Juarez unable to work.

Juarez received the federal unemployment benefit until Gov. Kim Reynolds ended the program in June, citing severe workforce shortages.

“When Kim Reynolds took away the benefit, it was almost like a sense of betrayal. That money was keeping us on our feet. That extra $300 per week meant staying alive, keeping my kids fed and keeping a roof over our heads in a time of uncertainty,” Juarez said. “Now the child tax credit means getting back on our feet and being able to provide for our children in a multitude of ways.”

Juarez hopes to use the credit to send Isabelle to summer camp – something that she’s never been able to afford – enroll Isabelle and Veda in swim lessons, set money aside for Isabelle’s college funds and save for the holidays. But her top priority is getting new brakes on her car.

Nonprofit leaders see the expanded tax credit as an empowering tool for families.

Michelle Book: “What’s really happening with the child tax credit is that we’re assuming that people – regardless of their level of income – can make the best decisions possible for their family. … With WIC and other assistance programs, there’s a huge amount of bureaucracy and red tape with that.”

Mary Janssen, Region 2 director, Iowa Child Care Resource & Referral: “It’s a great benefit for our families. I would love to hear stories of families in a year of how it impacted their life. Whether the credit goes toward child care or not, it’s still going to help them afford their child care bill and then that ultimately trickles down to help the child care center.”

Anne Bacon: “People with means might look at $300 per month and not think that it would make that massive of a difference. But to many families, it’ll be life-changing.”

Editor’s note: In future editions of Fearless, we’ll check back with Juarez and others to see how the credit affected their budgets. If you’d like to share your story, contact Fearless Editor Emily Blobaum at emilyblobaum@bpcdm.com.