Fewer women than men report feeling financially included, according to Principal research

Women and men still diverge in how they feel about financial matters. It’s a common finding in surveys and research, including by Des Moines-based Principal Financial Group. The company tracks many trends in consumer sentiment in service of its array of insurance, investment and other products.

A segment of data released this summer noted gender disparities in sentiment about financial access and inclusion. For example, the company found less than 40% of women feel they will be able to live as they wish in retirement; that figure is 51% for men.

“What I would say on a personal basis is that there still is a ton of work to do to make sure that women are feeling financially included,” said Kara Hoogensen, senior vice president and head of workplace benefits at Principal.

The data is tied to Principal’s annual Global Financial Inclusion Index; Principal’s full report is expected to be released in the coming weeks. Fearless sat down with Hoogensen to get more insight about the survey results and how to interpret them.

This interview has been edited for length and clarity.

I noticed that women are more pessimistic than men on many measures. What conclusions do you draw from that data?

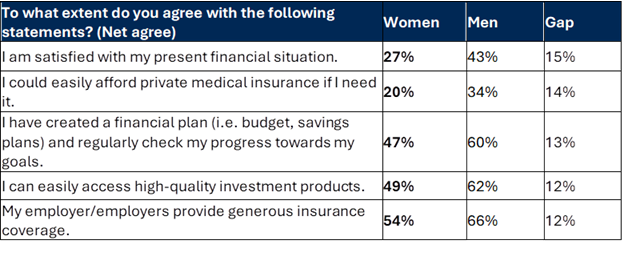

It does look across almost every measure, there’s at least a 10-percentage-point difference, or thereabouts. What I equate it to is confidence, to be really honest about it. I think we’ve all read different bodies of research that get at this point – that women are generally less confident than men.

We’ll talk about applying for jobs. If a male has three of the 10 needed characteristics, they’ll raise their hand for the position. But a woman will do so only if she has all 10 of the characteristics needed for the job. I think that same concept applies here. I’m making broad generalizations, but the need for more information, the need to understand things to a greater degree, and then having less confidence, contributes to the differences that we see.

It’s fair to point out that no one feels great about their level of financial security; both men and women consumers have less than 50% confidence in their financial security. But you see women having even less confidence than men.

One thing that jumped out to me was the sharp decline overall in people feeling financially included. I think the statistic was 85% in 2022 to 56% in 2024, and I know the survey isn’t really about why people feel that way, but what do you think?

The economic environment has been a key contributor to the year-over-year results in terms of financial inclusion. I also believe that there is an element of uncertainty. If we think about the context for this survey, it is consumers here in the United States. You look at the media, you look at the tone of messaging on social platforms, what people hear in the news – there’s just much more negativity. The current election cycle certainly isn’t helping that situation in any way.

I think it’s this combination of an economic environment that is more challenging, plus the negative tone, and then the third element I would add into this conversation is change. Fatigue is the way I would describe it. Although we’re several years past the start of the pandemic, change is happening at a greater pace than ever before. You hear this saying that now is the slowest that the rate of change will ever be going forward. I do think that, broadly speaking, there’s just an element of change fatigue that exists as well, and that is contributing. I am speculating, but that would be my hypothesis as to what’s going on.

How does the survey inform strategy and products that you work on at Principal?

Whether it’s the Global Financial Inclusion Index, whether it’s our Well-Being Index, or any of the ongoing voice of customer work that we do, we take all of those inputs and really leverage them to think about how we best communicate with our customers. Where might they be needing more information, where might they feel less confident? And are there additional steps that we can take to help make sure that the messages, the tools, the resources that we’re making available, are indeed hitting the mark?

One thing that surprised me a bit was fewer women saying they had access to generous employer-provided insurance coverage. Does that reflect men and women having different types of jobs that offer different benefits, or something else going on there?

Most employers shouldn’t be differentiating the benefits offering based on the gender of the individuals that are in the workplace. But what I do think that that indicates is that the communication approaches that are being used by the employers maybe aren’t hitting the mark with all of their employees equally. So that’s where I think making sure that employers are using more than one medium and, on a recurring basis, ensuring that they’re communicating about the benefits that are available through the workplace and taking the time to reinforce that periodically.

I also think it gets back to the confidence issue – maybe the women don’t feel like they’ve got the time to do the research to make informed decisions or haven’t taken the time to invest in fully understanding the benefits that are available to them. They’re just more time constrained – or, the avenues in which that information is being communicated, they are uncertain of how to access that information.

The state of Iowa has an initiative called SmartHer Money to improve women’s financial literacy. How does that relate to questions of access in the Principal survey? Do you think that could be a solution, as far as education?

I think it all ties together. When you know where you’re starting from, you’re more likely to take action and take the next best step. So a program like the state is supporting is a great foundational step to ultimately get a greater percentage of people, specifically women, in touch with organizations that can help them fulfill the needs that they identify.

Another thing I noticed from the survey: It seems people feel the government is not helping with financial inclusion, although they also have less confidence in financial systems and employers too. How should employers and banks respond to that kind of finding?

When we think about individuals and who they actually look to for guidance and access to resources and tools, it still is their employer at the top of the list. So that’s why a system like our retirement savings system, 401(k), why accessing benefits through the workplace is so important, because employers are a trusted resource, and they’re a gateway to help get important information to the broadest group of consumers possible.