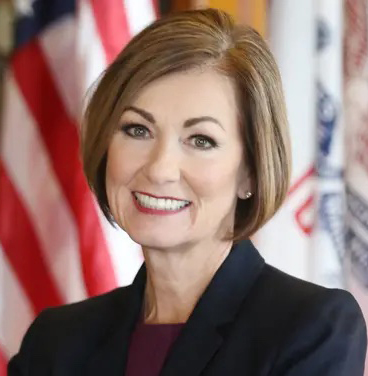

Reynolds pushes tax breaks for child care centers

Improving access to child care has been a bipartisan priority at the Iowa Statehouse for years. Although no single strategy will bridge the gap between the number of spaces available and what the state’s families need, lawmakers and Iowa Gov. Kim Reynolds are continuing to chip away.

The major effort that has emerged so far in the 2024 session is Reynolds’ proposal to tax commercial properties used for child care as though they are residential properties. That could mean cutting property tax bills for such properties nearly in half. Advocates said they hope the savings would be reinvested to help attract and retain staff and to, ultimately, make more child care more available.

Reynolds has said the plan also would enhance fairness, because commercial facilities would be taxed in the same manner as in-home child care providers.

Under Iowa law, property taxes for commercial property are levied against 90% of the property’s actual value above $150,000. All residential property, and the first $150,000 of each commercial property, owes property taxes, which fund local schools and government, on a smaller percentage of actual value. This is referred to as the residential rollback; presently, it’s set at about 46.34%. The state also appropriates money that is distributed to cities, counties, school districts and other local entities to replace the lost property taxes.

If a Dallas County property with an assessed value of $3.5 million was entirely used for child care, its property tax bill could drop by about $55,000. There is no current estimate for how many facilities statewide would be affected, but lawmakers said on Feb. 19 that they expect a nonpartisan analysis from the Legislative Services Agency.

The property tax change was one of the recommendations suggested in 2021 by Reynolds’ Child Care Task Force.

Reynolds’ proposal is part of a much larger tax plan that includes a decrease in income tax rates. Senate Study Bill 3038 got its first hearing Feb. 19. Lobbyists and lawmakers mostly praised the child care provision, although Sen. Pam Jochum, a Dubuque Democrat, said there might be more direct ways to improve child care availability.

“I think all of us have been trying to find ways to try to increase the number of child care spaces, and also more importantly, increase wages for the child care workers themselves,” Jochum said.

Sen. Dan Dawson, a Council Bluffs Republican, chairs the Senate Ways and Means Committee, which handles tax policy. He said he wanted lawmakers to investigate the various parts of Reynolds’ plan in a more focused way and split parts of it into individual bills.

Senate Study Bill 3181 contains only the child care property tax provisions. No initial hearing on that bill had been scheduled as of Feb. 21. The Iowa House Ways and Means Committee has not yet acted on Reynolds’ plan.